All Categories

Featured

Table of Contents

Note, nevertheless, that this doesn't state anything concerning changing for rising cost of living. On the plus side, even if you assume your choice would be to purchase the stock exchange for those 7 years, which you would certainly obtain a 10 percent annual return (which is much from certain, particularly in the coming decade), this $8208 a year would be even more than 4 percent of the resulting small supply worth.

Instance of a single-premium deferred annuity (with a 25-year deferral), with 4 settlement choices. The regular monthly payment here is highest for the "joint-life-only" option, at $1258 (164 percent greater than with the instant annuity).

The means you purchase the annuity will determine the response to that question. If you get an annuity with pre-tax dollars, your costs decreases your gross income for that year. Ultimate settlements (monthly and/or swelling amount) are strained as regular earnings in the year they're paid. The benefit below is that the annuity might allow you postpone taxes past the IRS payment limits on IRAs and 401(k) plans.

According to , acquiring an annuity inside a Roth plan results in tax-free repayments. Getting an annuity with after-tax dollars beyond a Roth leads to paying no tax obligation on the section of each settlement attributed to the initial premium(s), but the staying section is taxable. If you're establishing up an annuity that starts paying before you're 59 years of ages, you might need to pay 10 percent early withdrawal charges to the internal revenue service.

How do I apply for an Lifetime Payout Annuities?

The consultant's first step was to create a comprehensive monetary prepare for you, and after that explain (a) just how the proposed annuity matches your total plan, (b) what choices s/he taken into consideration, and (c) exactly how such options would or would not have actually caused reduced or greater payment for the advisor, and (d) why the annuity is the premium choice for you. - Income protection annuities

Certainly, an advisor may attempt pressing annuities also if they're not the very best fit for your scenario and goals. The reason could be as benign as it is the only item they market, so they fall prey to the proverbial, "If all you have in your toolbox is a hammer, rather quickly everything starts appearing like a nail." While the expert in this scenario might not be dishonest, it boosts the threat that an annuity is a poor option for you.

What types of Annuity Income are available?

Given that annuities commonly pay the agent selling them much greater compensations than what s/he would get for spending your cash in mutual funds - Tax-efficient annuities, allow alone the absolutely no payments s/he would certainly receive if you purchase no-load shared funds, there is a big motivation for representatives to push annuities, and the more complicated the better ()

A deceitful advisor recommends rolling that quantity into brand-new "far better" funds that simply occur to carry a 4 percent sales lots. Consent to this, and the advisor pockets $20,000 of your $500,000, and the funds aren't most likely to do much better (unless you selected even more inadequately to start with). In the very same example, the consultant could guide you to acquire a challenging annuity keeping that $500,000, one that pays him or her an 8 percent compensation.

The advisor hasn't figured out exactly how annuity repayments will be tired. The expert hasn't divulged his/her compensation and/or the fees you'll be charged and/or hasn't revealed you the influence of those on your eventual repayments, and/or the compensation and/or fees are unacceptably high.

Your family members background and current health indicate a lower-than-average life expectations (Annuity payout options). Current rates of interest, and thus predicted settlements, are traditionally reduced. Even if an annuity is ideal for you, do your due persistance in comparing annuities sold by brokers vs. no-load ones sold by the providing firm. The latter may require you to do even more of your own research study, or use a fee-based monetary advisor that might get payment for sending you to the annuity company, yet may not be paid a greater compensation than for other financial investment choices.

What should I know before buying an Long-term Care Annuities?

The stream of month-to-month settlements from Social Safety and security resembles those of a postponed annuity. A 2017 relative analysis made a comprehensive comparison. The adhering to are a few of the most salient factors. Considering that annuities are volunteer, individuals purchasing them usually self-select as having a longer-than-average life span.

Social Protection benefits are totally indexed to the CPI, while annuities either have no inflation protection or at most provide a set percent annual increase that might or might not make up for rising cost of living completely. This kind of rider, just like anything else that raises the insurer's risk, needs you to pay more for the annuity, or accept reduced settlements.

Why is an Retirement Annuities important for my financial security?

Disclaimer: This short article is meant for informative purposes just, and must not be considered financial suggestions. You ought to speak with a financial specialist before making any significant monetary decisions. My job has actually had lots of unpredictable weave. A MSc in academic physics, PhD in speculative high-energy physics, postdoc in bit detector R&D, research setting in speculative cosmic-ray physics (including a number of brows through to Antarctica), a quick job at a small design services firm sustaining NASA, complied with by starting my own small consulting practice supporting NASA jobs and programs.

Considering that annuities are meant for retirement, taxes and fines may apply. Principal Defense of Fixed Annuities.

Immediate annuities. Used by those that want trusted revenue quickly (or within one year of acquisition). With it, you can tailor income to fit your demands and develop revenue that lasts forever. Deferred annuities: For those that intend to grow their cash gradually, but agree to delay accessibility to the money up until retirement years.

How long does an Fixed-term Annuities payout last?

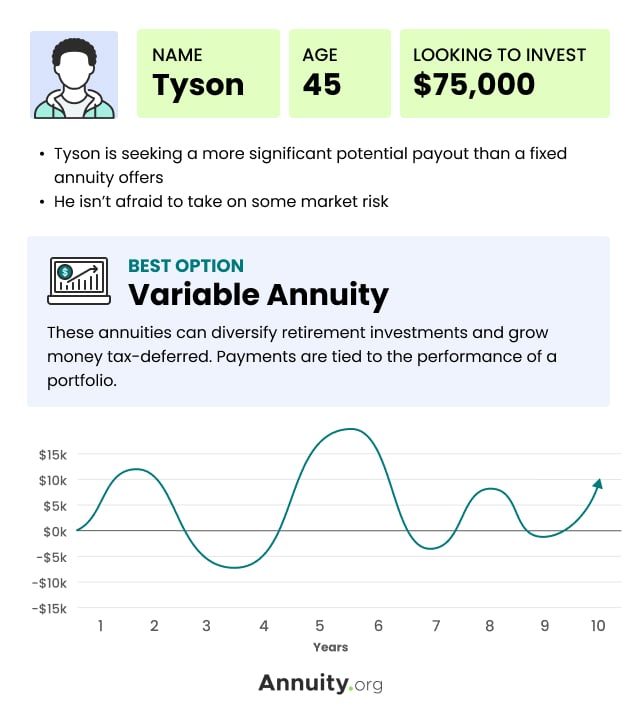

Variable annuities: Provides better capacity for growth by investing your cash in investment options you select and the capacity to rebalance your portfolio based on your preferences and in a method that aligns with changing financial goals. With repaired annuities, the company spends the funds and offers a rates of interest to the client.

When a death case happens with an annuity, it is very important to have actually a called beneficiary in the agreement. Various alternatives exist for annuity fatality advantages, relying on the contract and insurance provider. Selecting a reimbursement or "duration certain" alternative in your annuity offers a death benefit if you die early.

How do I receive payments from an Fixed Indexed Annuities?

Calling a beneficiary various other than the estate can aid this procedure go a lot more smoothly, and can aid guarantee that the proceeds go to whoever the specific wanted the cash to go to instead than going via probate. When existing, a fatality advantage is instantly included with your agreement.

Table of Contents

Latest Posts

Breaking Down What Is Variable Annuity Vs Fixed Annuity A Closer Look at Fixed Vs Variable Annuity Defining the Right Financial Strategy Features of Fixed Index Annuity Vs Variable Annuities Why Choos

Understanding Financial Strategies A Closer Look at Pros And Cons Of Fixed Annuity And Variable Annuity Breaking Down the Basics of Investment Plans Advantages and Disadvantages of Fixed Annuity Vs Eq

Understanding Fixed Indexed Annuity Vs Market-variable Annuity Key Insights on Your Financial Future Breaking Down the Basics of Investment Plans Pros and Cons of Pros And Cons Of Fixed Annuity And Va

More

Latest Posts